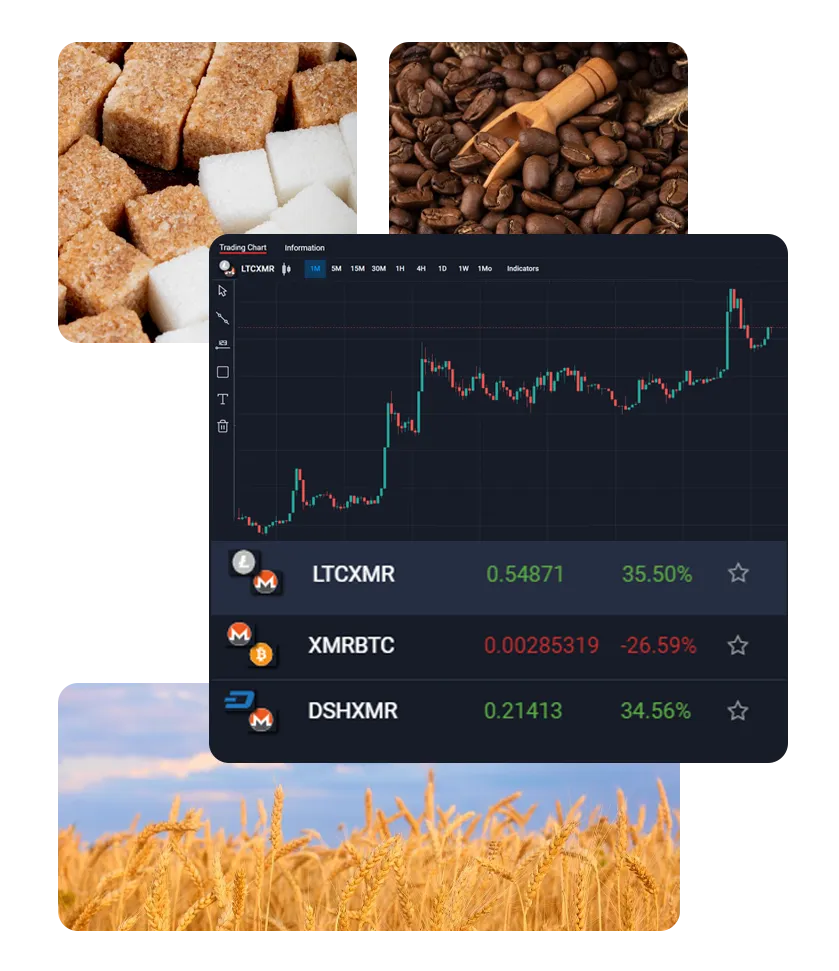

Embracing the Dynamics of Soft Commodities Trading with Nexa-global

In the ever-changing world of soft commodities trading, understanding and leveraging market volatility is key to success. This volatility, influenced by a myriad of factors like weather patterns, crop conditions, global economic policies, and consumer trends, is what makes soft commodities trading both challenging and rewarding. By grasping these market dynamics, traders are better positioned to anticipate price movements and strategize for potential gains.

Balancing Risk and Reward in Soft Commodities with Nexa-global

While trading in soft commodities offers avenues for profit, it’s crucial to recognize and manage the associated risks. The very factors that contribute to price volatility can also lead to potential losses. However, with Nexa-global’s comprehensive analytical tools and strategic planning resources, traders can effectively mitigate these risks and tap into the lucrative opportunities that soft commodities trading offers.

The Benefits of Trading Soft Commodities with Nexa-global

Short Selling Opportunities

Nexa-global enables traders to profit from declining commodity prices through short selling, offering an edge in bearish markets.

Futures Contracts Trading

For those bullish about a commodity’s prospects, Nexa-global facilitates the trading of standard futures contracts, allowing you to benefit from rising prices.

Secure Investment Avenue

Soft commodities are often considered a stable investment choice. Nexa-global ensures your investments are protected within our secure trading environment, offering you peace of mind as you engage in commodity trading.

Nexa-global – Secure, Sophisticated, and Innovative Trading Solutions.

Trade with Precision, Earn with Confidence. Discover the World of Soft Commodities Trading with Nexa-global.

Get Started